Timing is important. You don’t want to start paying a mortgage for a house that isn’t ready for you to move into.

A mortgage for a new-build house has differing criteria, for example, lenders’ terms may differ according to any deal you make with the developer on discount, as well as require that the house be built according to certain building industry standards.

If you’ve seen a new-build house and are keen to progress, talk to us soon. We’re mortgage advisers who can access thousands of mortgages, and as there are extra administrative hoops with mortgages for new build, we can make sure we are scanning the market for the right deal for you and getting everything ready in time.

We’ll move fast to get your new build mortgage arranged to avoid any delays on moving-in day, and aim to make the process as stress-free and straightforward as possible. We’ll explain everything in clear language, keep you updated, do the chasing, and even the paperwork if you need us to.

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend upon your circumstances. The fee is up to 1%, but a typical fee is 0.3% of the amount borrowed.

Where do you go from here?

You can make an appointment to talk to one of our friendly mortgage experts, either in person or on the phone, at a time to suit you.

You can contact us now on 0300 303 0913 and speak to one of our team right away.

You can fill out our quick enquiry form to request a callback.

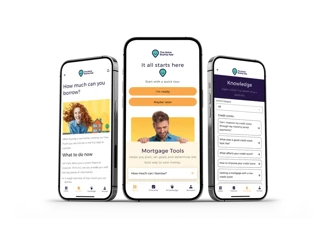

The Home Buying App

Our app helps you to work towards the goal of getting your own home

Use our savings trackers, step-by step checklists, and lots of useful guides.